North East Development Capital Fund

Debt, mezzanine and equity finance from £400,000 to £2 million for SMEs located across North East England.

Take the next step in your growth journey

Investments from £400,000 - £2 million

Range of funding options available: Debt finance, mezzanine loans or equity investment.

Available to North East businesses

Available to SMEs across Durham, Northumberland and Tyne and Wear.

Flexible funding to support growth

Funding packages can be tailored to individual business needs and growth strategy.

Available to established SMEs

Targets dynamic companies with strong management teams and ambitious growth plans.

About the Fund

The North East Development Capital Fund, supported by the European Regional Fund, is part of The North East Fund, a £120 million investment programme set up to support the growth ambitions of SMEs across Durham, Northumberland and Tyne and Wear.

The Fund can invest from £400,000 to £2 million by way of debt finance, mezzanine loans or equity investment. The primary focus is on supporting established North East businesses with strong management teams who have ambitious growth plans for their local business.

Helping you grow your business

The North East Development Capital Fund is designed for small businesses that need additional capital to grow, and can support a wide range of business finance needs including:

Purchasing new machinery

Capital Expenditure

Sales and marketing

Investing in new products

Hiring a new team

Providing working capital

Latest news & insights

News

Maven invests a further £1 million in iPac Innovations

News

Maven invests a further £1 million in iPac Innovations

News

Power Roll receives further investment

News

New Female Founder Funding Programme launched

Insights

Episode 9 of Invested featuring CEO of Power Roll Neil Spann out now

Case Study

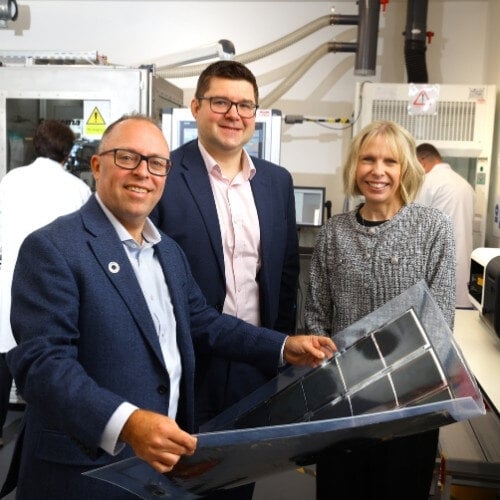

Dyer Engineering doubled its workforce and grown revenues to £18 million with Maven investment

Our local team

Our investment and portfolio executives come from a variety of commercial, financial and industry backgrounds with collective experience and skills, built up over many years, of supporting fast-growing businesses throughout the UK. Our team is here to ensure that you are one step closer to fulfilling your business's growth potential.

No matches

Frequently asked questions

What is the North East Development Capital Fund?

Managed by Maven, The North East Development Capital Fund (NEDCF) is part of the North East Fund, an investment programme to support high-growth businesses in the North East of England. The fund can provide capital to help companies pursue their growth plans by purchasing new machinery, investing in new products, expanding their operations or entering new markets.

Who can apply for funding?

High-growth and established SME businesses based in the North East of England can apply for funding.

What types of funding are available?

Debt finance, mezzanine loans or equity investments ranging from £400,000 to £2m.

What is the process for applying for funding?

The application process involves submitting an online application form and providing details of your business plan and financial projections. The Maven team will review your application and arrange a meeting to discuss your proposal further.

How long does the application process take?

The application process typically takes around 6-10 weeks from the initial application to receiving funding.

What is the repayment period for equity investments provided by the NEDCF?

The repayment period will vary depending on the specific terms of the agreement. Maven’s investment team will discuss repayment terms with you during the application process.

Can businesses apply for funding for any purpose?

Funding can be used for a range of purposes including expansion, product development, marketing and working capital.

What are the eligibility criteria for funding?

To be eligible for funding, businesses must be based, or willing to relocate a material part of your operations, in the North East of England and have growth potential. They must also demonstrate a viable business plan and be able to demonstrate how the funding will help them achieve their growth ambitions.

Who can I contact for further information?

You can contact the NEDCF team directly through their website or by emailing northeast-enquiries@mavencp.com for further information.