Guide to Claiming VCT Initial Tax Relief

Maven is one of the leading Venture Capital Trust (VCT) fund managers, with a VCT heritage spanning over 20 years. This guide explains the process of claiming initial tax relief on your VCT subscription.

| Important Information Please note that Maven cannot give any investment, legal or taxation advice in respect of any fund or product featured in this document. This document is not an invitation or a recommendation to invest and is for information purposes only. This document is a summary of Maven’s understanding of the current rules regarding VCT tax reliefs and how they should be claimed. The tax reliefs available to individuals will be dependent on personal circumstances. Shareholders and potential investors are recommended to consult a specialist qualified adviser regarding the taxation treatment of an investment in a VCT. Investors who are not resident in the UK are recommended to seek advice regarding their overseas tax position. |

Introduction to claiming VCT tax relief

UK tax payers who invest in new VCT shares can benefit from a range of tax reliefs on that investment, including up to 30% initial income tax relief* and relief from income tax on their dividends, for subscriptions of up to £200,000 in any tax year. These tax benefits were introduced to encourage investment into emerging UK private companies with high growth potential.

So how do investors actually claim the initial income tax relief on their new VCT shares? It is a fairly straightforward process, but there are different approaches based on how you currently pay your tax. This step-by-step guide will walk you through the common tax situations for investors.

* Initial income tax relief is only available to the extent which reduces the Investor’s income tax liability to nil (as at November the rate of the initial tax relief is 30% but, as announced in the 2025 Autumn Statement, that will change to 20% from 6 April 2026). Please note that new VCT shares must be held for at least five years after issue, or any Income tax relief received must be paid back. The reliefs available on an investment are reduced if the investor also disposes of existing shares in the same VCT within six months before or after the subscription for new shares. Tax reliefs could change in the future if there are amendments to the VCT rules. If you are in doubt about the tax rules, you should seek advice from a specialist advisor.

Your documents

Once you have invested in a VCT, you will receive two certificates (for each VCT in which you invest).

- Your VCT share certificate (unless you choose to have your Shares issued directly through CREST in the name of a nominee), which shows how many shares you own. Keep this safe, as it is your legal proof of ownership of the shares and you’ll need it if you sell your shares.

- Your income tax relief certificate (ITRC), which will enable you to claim your initial income tax relief from HMRC.

Once your shares have been issued and you have your share certificate, you can claim initial tax relief for the tax year in which the shares were issued.

You can claim income tax relief either using your self-assessment tax return, or by writing to HMRC to request a tax coding adjustment under the PAYE system.

HMRC does not normally require you to send them your ITRC, however, you should keep these safe should HMRC ask you to produce them in support of your claim for tax relief.

How to claim using your self-assessment tax return

If you complete a paper application

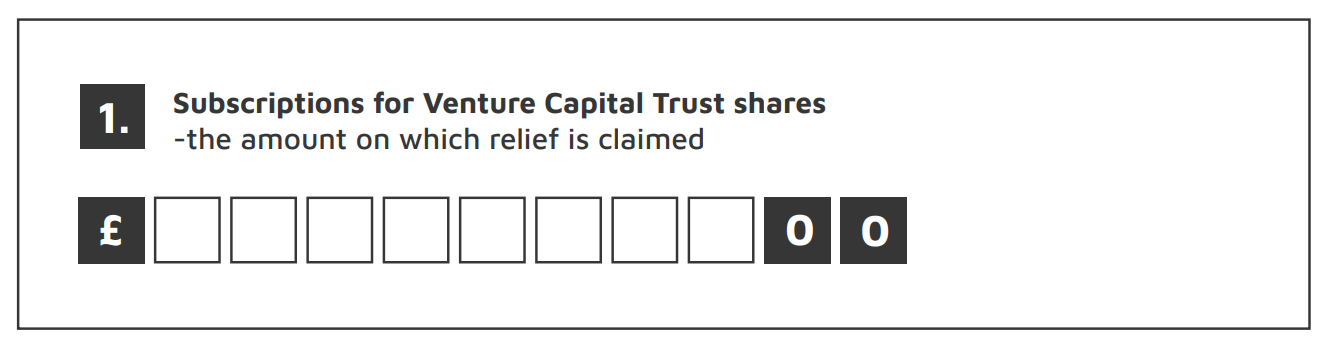

There is a section on the form dedicated to VCTs. Go to the ‘other tax reliefs’ section on the Additional Information (SA101) pages.

Enter the total amount subscribed* (in all VCTs for that tax year) in section 2:

That’s it. You should then receive the income tax relief from HMRC through your tax calculation (such that the tax payable for the year will be reduced and any overpayment would be refunded). If you are self-employed, this will be done by a reduction in your instalment payments and will require you to submit a copy of the ITRC for the VCTs you invested in.

If you complete an online self-assessment

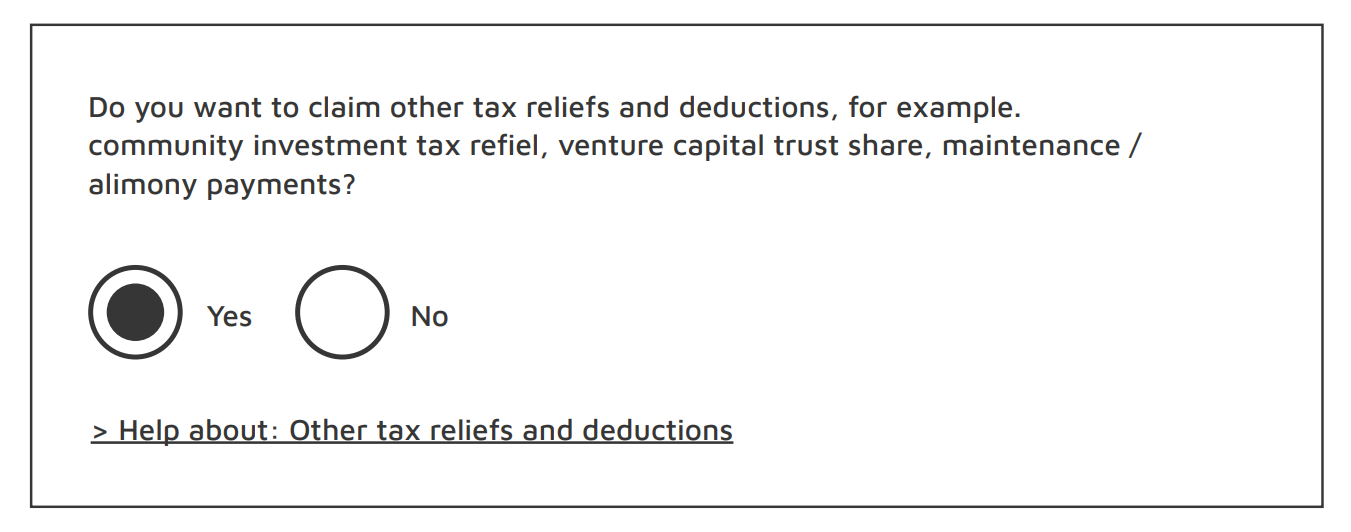

Within section 3 you will be asked if you want to claim other tax reliefs and deductions.

Select ‘yes’ as this question is directly related to venture capital trust shares:

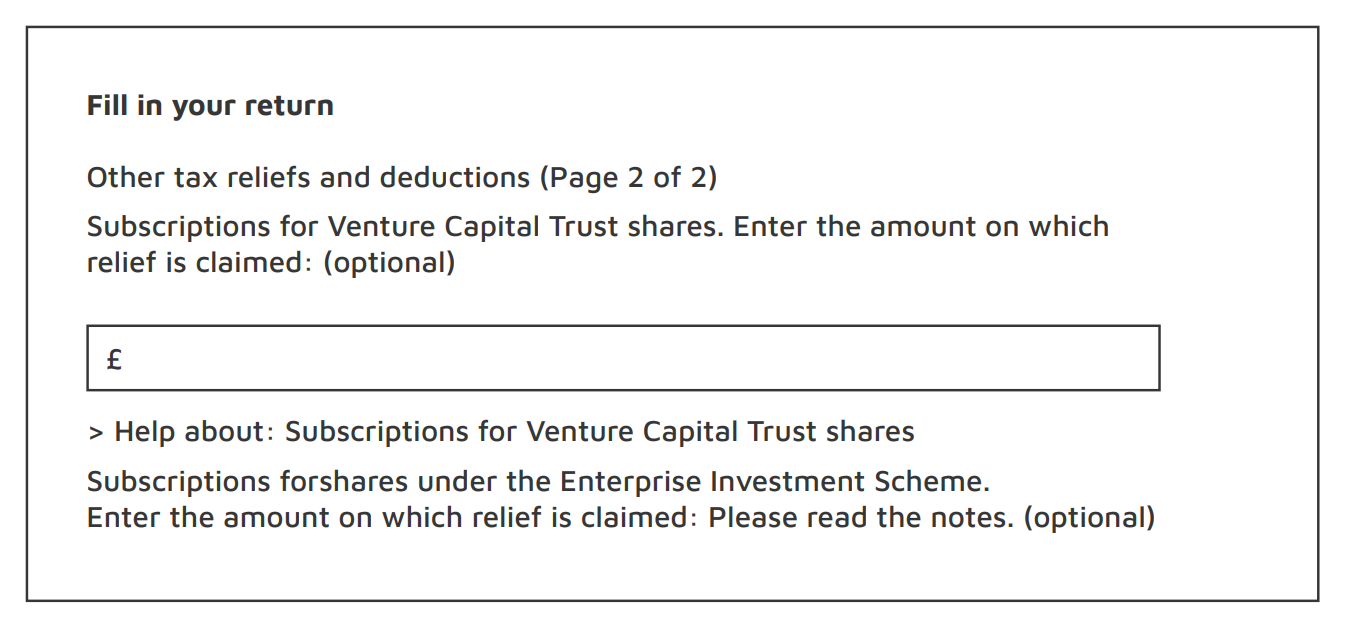

Then in section 4 you will see the question ‘Other tax relief and deductions’. On page 2 you will be asked to enter the amount on which relief is being claimed. Simply type in the total amount (£) you have subscribed* (in all VCTs) for in that tax year:

That’s it. You should then receive the income tax relief from HMRC through your tax calculation (such that the tax payable for the year will be reduced and any overpayment would be refunded). If you are self-employed, this will be done by a reduction in your instalment payments and will require you to submit a copy of the ITRC for the VCTs you invested in.

*This will be shown on your ITRC(s) as something like ‘Amount Paid’ – check your tax certificate because sometimes your subscription may be split between more than one VCT, or part of the funds you pay for a VCT application may not be eligible for relief if they were to pay an adviser fee.

How to claim through an adjustment of your tax code

If the tax year has not yet ended and you pay tax at source through PAYE, you can write to your local tax office to claim VCT tax relief either through an adjustment of your tax code (you should enclose your ITRC(s) for your VCT investment, your national insurance number and a P60 form). You should then see an adjustment made to your tax coding, such that the income tax you pay each month will be reduced to reflect the tax relief you are entitled to. If the tax year has ended, then you should request a repayment, but it is likely that you will be required to submit a tax return.

Further Information

If you would like to find out more about the Maven VCTs, get in touch:

0141 306 7400

enquiries@mavencp.com